noetic dreams

dreams.....it rules everyone.!we yearn for some..even when wild...or fancy.....what if it is noetic ?

Sunday, August 18, 2013

Sunday, March 18, 2012

Budget Musings -2

Let me put it

like this . Indirect taxes pinches all equally , but poorer segment feels more

pain than the well off. Whereas, the

direct taxes pinches the people variedly according to their wealth, so

everybody feels same pain. Hence direct taxes are progressive. And economists

opine that ratio of direct taxes should be higher than the indirect taxes.

As discussed, by nature, indirect taxes are

regressive. But, by the way of tax policies, exemption etc., tax policy tries

to makes it, to put it correctly, less regressive. We discuss regarding this

elaborately.

I thought, I

should say some background about its nature, so that our understanding of budget is made easier.

As a common

man, I feel that first slab of Rs. 2,00,000 is very less, but considering the

overall fiscal situation this decision might be unavoidable. Increase in tax

slab might again have a deeper dent in revenue.

As we all see

in the news, real hot pepper lies in indirect proposals; Widely Termed as

harsher, unprecedented. This is affirmed by the words of Hon`ble FM, who quoted

Shakespeare “I am being cruel , just to be kind “. We shall see , what s cruel? what s kind in it

As is being discussed in media, Its cruel because, increase in excise duty and service tax to 12% surely would push up inflation. Many services earlier not within the ambit of tax net may be covered this year, due to changes in act this year.

What is kind in it ?

Saturday, March 17, 2012

Budget Musings !!!

" 10% , sure shot .. there is going to increase in gold smuggling " told my collegue , as FM announced increase in import duty of gold from 5%. we ,were at Conference hall, listening to Budget speech. This is an annual event in every tax dept. offices as tax proposals will have bearing on our work in the coming year.

This is more important in custom Houses, where our assessments will be based on the rates announced during Budget presentation from very next day. ya ! you can ask me .. who gave you authority to impose the new rate, when it is yet to be passed in parliament ? .. provisional collection of taxes act gives us authority, so as to avoid manipulation. so every one was tallying, what went up ? what down ? changes ?

shakthi messaged me " tell me ! this budget is good or bad " , I am sure, I am not macro economist or tax policy maker. I am just a novice tax administrator, leave alone tax policy.

Budget is a annual financial statement for the country. Its a big document containing briefly balance sheet, expenditure proposal, tax proposal, some economic reforms, amendments, fiscal health and so on. To read & understand only ,It needs some expertise., leave alone its implications.

But, Having spent two years in training and nearly an year in field, I just tried to give a try only in indirect tax proposals. It comprises of Customs, Excise duty and service tax.Its called so , because its indirectly paid by the consumers.

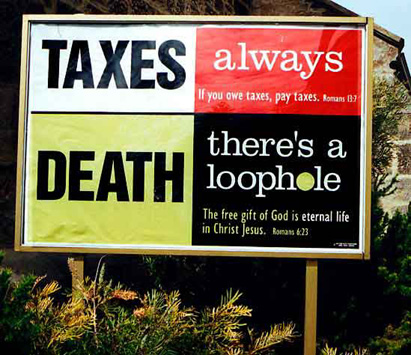

FM in recent years is relying on indirect tax for mopping up the revenue.This will have direct implication on prices and thus inflation. May be, I think Perception is more important. Income tax collected directly from us pinches ( apparently), than the indirect tax which is paid indirectly by us.( 10 % vs. 12% ) ... Income tax is said to be progressive in nature. why progressive ? ...

Subscribe to:

Posts (Atom)